Business Overview

History

Adyen (headquartered in Amsterdam) was founded in 2006 by Pieter van der Does and Arnout Schuijff, seasoned payment technology professionals who had previously worked together at Bibit. Observing that payments technology was highly fragmented and built on outdated infrastructure, the co-founders set out to build a singular platform for merchants to accept payments.

Business Model

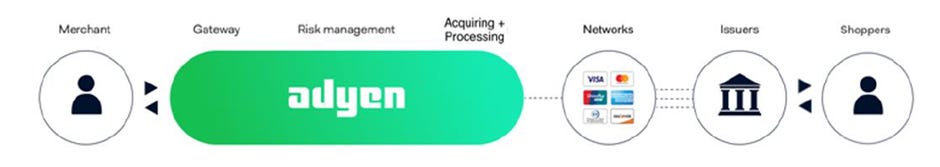

Adyen serves both digital-only and omnichannel merchants. As depicted in the figure below, Adyen’s platform handles multiple aspects of the payment cycle for merchants:

Gateway: payments acceptance

Risk management: fraud prevention

Acquiring and processing: routing of a payment transaction onto a card network

Adyen’s platform offers simplicity to merchants by eliminating the need to work with disparate payment services.

Over the years, Adyen has obtained acquiring licenses across various geographies (including Europe, APAC and North America), allowing Adyen offer global coverage by accepting payments on the payment networks within these respective regions. Adyen connects to large global payment networks such as Visa, Mastercard and American Express as well as local networks e.g. AliPay, WeChat Pay.

Historically Adyen has targeted large, global merchants however it has increasingly started also focusing on mid-market merchants.

Financials

Adyen earns revenue through charging a fixed processing fee, as well as a percentage-based settlement fee to merchants.

Growth

Adyen has historically enjoyed strong growth, with revenue growing in the ~40% CAGR range before and during COVID. Growth was primarily driven by increased payment volume from existing merchants already on Adyen’s platform. More recently, growth slowed in the first half of 2023, driven by increased competition, and merchants becoming increasingly focused on cost reductions.

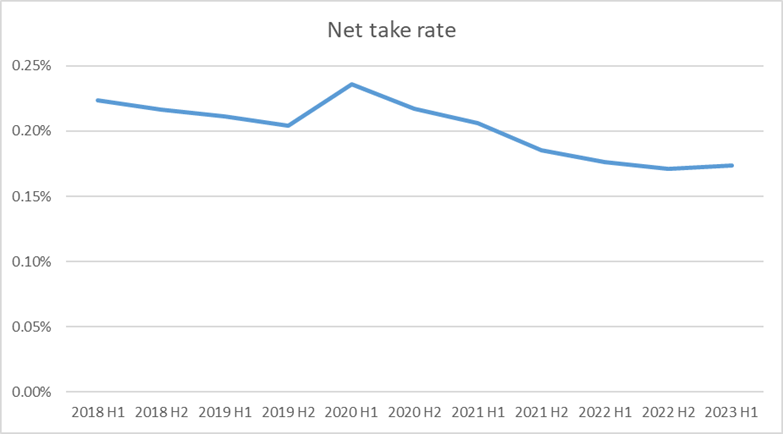

Take Rates

In 2022, Adyen did €767.5bill in processed payment volume, and €1.33bill in net revenue, resulting in a net take rate of 17bps. Adyen’s net take rate was higher in prior years, reaching 23bps in 2020, and has since declined due to higher payment volumes from existing merchants (who can renegotiate terms with Adyen).

Profitability

Adyen is highly profitable, due to being asset-light as well as having low operating expenses (very low stock-based compensation compared to US players), resulting in very strong EBITDA margins of 50-60% over the past few years. EBITDA margins fell to 43% in the latest half-yearly period due to a ramp up in hiring of more sales people to pursue growth opportunities in the US. Management have signalled that hiring will be more measured going forward, which should allow EBITDA margins to creep back up.

Industry Overview

The payments ecosystem is comprised of many players that each perform distinct roles:

Payment Gateways:

These companies provide the necessary hardware/software that enables merchants to accept payments from customers

This function may be handled by the merchant’s bank, or a separate company such as Stripe, Square, Clover, etc

Payment Processors:

These companies process payments on behalf of a merchant, by routing it onto a payment network and handling authorisation and settlement

Players include Stripe, Square, Braintree

Acquirers/acquiring banks:

These are financial institutions (usually a bank) that accept credit and debit card payments (from customers) on behalf of a merchant

Issuers/issuing banks:

Financial institutions (usually a bank) that issues credit and debit cards for customers

Card Networks:

Payment networks serve as an intermediary between acquirers and issuers, routing transaction information from the acquirer to the issuer, and facilitating the exchange of funds between parties via settlement banks

Major global payment networks include Visa, Mastercard and American Express

Here is an explanation from Adyen’s website of how a transaction works which ties everything together:

Adyen differentiates itself within the payments ecosystem by acting as a unified solution for merchants, by serving as the acquirer, payment gateway and processor

Investment Thesis

Continued Growth Runway

Adyen is well positioned to benefit from the continued growth of the digital payments market (forecasted to grow at a CAGR in the low teens over the next few years). In Adyen’s major markets, there is still room for digital payments to take share from cash payments.

Based on studies conducted, cash comprised 20% of payments for US respondents surveyed in 2021, and 59% of payments for European respondents surveyed in 2022.

Adyen also expects to see revenue growth that outpaces the overall payments market, driven by driven by share of wallet gains (from existing merchants) as well as new customer wins. At their latest investor day, they shared that they expect revenue to grow in the low-to-high twenties range.

Execution

Adyen sets itself apart from other players by demonstrating a strong preference for building capabilities internally rather than relying on M&A. This deliberate strategy enables Adyen to maintain control over its product development cycle, pushing out product updates on a monthly basis. Adyen has successfully navigated an increasingly complex payments ecosystem on behalf of merchants. Adyen has been able to accommodate a diverse set of payment methods, including traditional card payments, Buy Now Pay Later, and mobile payments.

“Now at Adyen, we invest a lot of time in innovation and making sure that we are always first to market when it comes to things that matter. These are two examples. We were in the U.S., the first player among the first players to go live with network tokens and debit routing. We've been optimizing ever since we launched.” – David Strazza (Adyen US President), Adyen Investor Day

“So the complexity in the market, we try to solve by keeping our solution simple. This is why we are so focused on building everything we do on a single platform solution, running our own licenses that we control, running technology and developing the solution with our own engineering teams, controlling everything end-to-end, no third-party dependencies. This is really important to us because it means we can adapt quickly to change, and it means we control everything, and therefore, we can control the quality of the solution. And it's a unique approach.” – Roelant Prins (Chief Commercial Officer), Adyen Investor Day

Unique Culture and Long-Term Focus

Adyen prides itself on fostering a unique culture characterised by individual autonomy for its employees. Adyen maintains a lean workforce of smaller, high-performing teams that are highly efficient, whilst also striving for transparent communication within the organisation. Approximately half of Adyen’s workforce are tech employees.

To preserve its culture, Adyen has a hiring process that is very selective, with Board members actively participating in final conversation with candidates. Adyen is only hires those who are excited to solve problems and wish to build a long-term career at the company.

Notably, Adyen’s recent ramping of hiring despite other competitors conducting layoffs demonstrates their ability to remain focused on long term growth opportunities.

Risks

Intense Competition in Payments Processing

Adyen’s closest competitor is Stripe who processed USD$817bill in payment volume in 2022, compared to Adyen’s €767bill (~USD$830bill). Stripe’s net take rate of 34bps in 2022 is also higher than Adyen’s 17bps. Stripe’s higher take rates is due to its customer base predominantly comprising of smaller businesses, whereas Adyen predominantly targets larger enterprises who have greater negotiating power. Stripe had negative EBITDA in 2022, due to a much higher headcount of 6,950 compared to Adyen’s 3,332. Competition between Stripe and Adyen is likely to increase going forward as Adyen continues to pursue the US market, where Stripe is already a dominant player.

Braintree (another player owned by PayPal) has also been engaging in aggressive price wars to capture market share in the US. This was alluded to by Adyen’s management in their latest earnings call when explaining why they saw TPV growth slow from 45% in H2’22 to 23% in H1’23.

Expert call commentary also points out that the technological gap between Adyen and competitors has narrowed over the years, and customers are increasingly focused on lowering costs given the more challenging economic environment.

Low Bargaining Power Over Large Customers

Large enterprises tend to use multiple payment processors for redundancy, and route transaction volume through a processor based on performance. Due to their larger payment volumes, large enterprises are also able to renegotiate processor fees every few years. Adyen is unlikely to see its take rates increase unless it can shift its customer mix more towards smaller businesses.

Possible Further Erosion of Margins

While Adyen has experienced significant growth in recent years, much of it has been driven by volume growth from existing customers. Adyen’s ramp-up in efforts to win new customers may require further hiring of sales people, which may put pressure on margins.

Adoption of The Payment Orchestration Layer

A payment orchestration layer may be either offered by an off-the-shelf provider (e.g. GR4VY or IXIOPAY) or self-built by a merchant that has the financial resources to do so. It allows merchants to deal with banks, acquirers and payment service providers through a single software layer. Various benefits of using a payment orchestration layer include lower costs, no vendor lock-in, and being able to dynamically route transactions (e.g. setting rules to route through the cheapest payment processor). There is a risk of companies like Adyen being abstracted away and no longer having a direct relationship with merchants, leading to its position being further commoditised in the payments ecosystem.

Valuation

Adyen has seen significant multiple compression over the years, with EV/EBITDA multiples falling from 110x in 2020 to 37x currently (the fintech space traded at stupid valuations during COVID). The multiple compression was partly driven by a change in market environment which saw a selloff in expensive stocks. In 2023, Adyen saw a 39% single day drop from the H1 2023 earnings results, due to a big slowdown in North America revenue growth rates, and commentary around increased competition which forced a reset in expectations.

Adyen subsequently saw a strong recovery from its recent lows, due to its recent Investor Day where management released revised long-term growth targets that appeared more realistic.

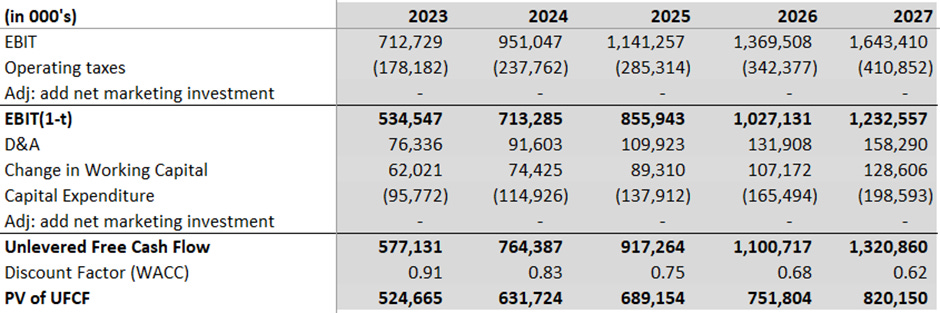

DCF Valuation Key Assumptions

Assume processed volume grows at 20% CAGR

Net take rate stays at 17bps

EBITDA margin improves from 49% to 55% over next 5 years

Exit multiple of 22x EBITDA

The resulting fair value of ~€1,000 per share yields a ~10% IRR. Based on this valuation, the current share price presents a reasonable entry point, however I personally feel weary of the increasing competitive dynamics that Adyen faces and would prefer a higher IRR as compensation for the greater uncertainty.

Useful Resources

Good primer by Business Breakdowns on Adyen’s history and business model

https://www.joincolossus.com/episodes/30866661/willar-adyen-a-first-principles-payment-platform

Good overall investment write-up on Adyen

Helpful post about the competitive dynamics Adyen faces

https://stratechery.com/2023/adyen-earnings-adyens-european-context-adyen-vs-stripe/

Thank you for reading! If you enjoyed the post, please hit the subscribe button below for similar content in the future and also follow me on Twitter @inverse_DK. Feel free to leave any feedback or comments below, or DM me on Twitter.

Thank you for referencing our write up