Market Update and Quick Thoughts on Stocks (GOOGL, AMZN, META, Hermes, Semis, BKNG, BABA, JD)

GOOGL, AMZN, META, Hermes, NVDA, AVGO, TSM, AMAT, BKNG, BABA, JD

Market views

What started off as a strong start to the year has quickly turned into a painful one, driven by increased uncertainty over Trump’s trade policies. Freshly announced tariffs on Liberation Day struck fear in the markets, with ‘reciprocal’ tariffs imposed on all US imports, notably 34% on China and 20% on Europe.

These tariffs have bearish implications for US consumer discretionary companies that use Asian suppliers. Companies such as Nike and Lululemon unsurprisingly sold off.

To make matters worse, China announced retaliatory tariffs of 34% on the US the following day, indicating they aren’t willing to enter negotiations at this stage, causing more uncertainty and selling off in the markets.

I’ve been a buyer of this dip, but I’m weary of the possibility that tensions between US/China continue to escalate and that things could get worse before they get better – so still making sure I have plenty of dry powder in case there’s more of a selloff.

Some rapid fire thoughts on various companies:

Alphabet (GOOGL), Amazon (AMZN), Meta Platforms (META)

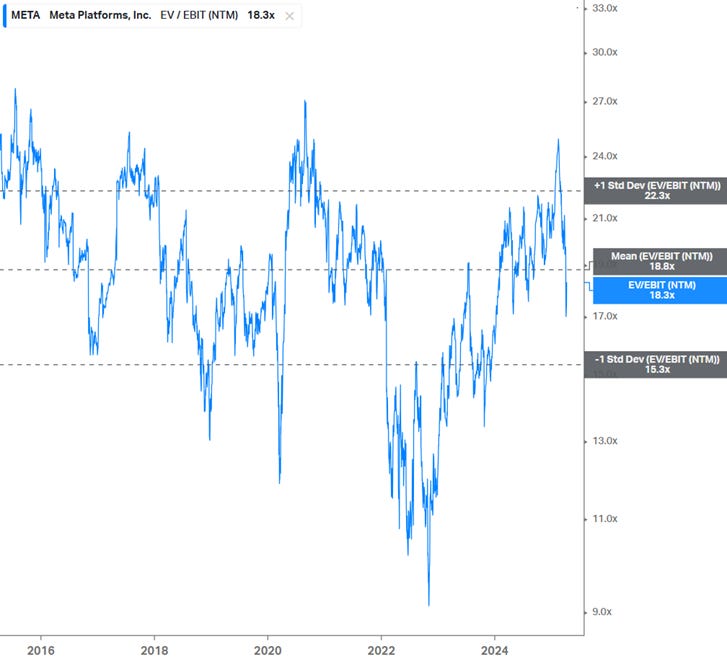

I added to my existing positions here as the selloff has brought the valuation multiples of these stocks back to multiyear averages (but GOOGL is by far the cheapest out of the 3 currently).

Alphabet has a strong competitive position in AI (but admittedly their ability to productise their AI offerings has been inferior compared to OpenAI). Their core search business remains strong but there are longer term existential risks from AI and whether Alphabet can effectively disrupt itself before being disrupted by others. Their AI models are competitive with OpenAI’s, and I think in the long run there will be significant value in owning your own models. I think the low multiple provides enough compensation for the uncertainty around Alphabet’s future.

Amazon isn’t a frontrunner in the AI race, but they have a very strong positions in e-commerce, Cloud infrastructure services and digital advertising. The US government recently ended the de minimus rule on items valued under $800 shipped from China/HK into the US, which means low value items are now charged with duties and taxes, which may be a headwind for the portion of Amazon’s e-commerce business derived from Chinese sellers.

Meta is a solid AI play – they own their own models which are competitive with OpenAI, and its very clear to see how AI will benefit their business, Better AI technology means the ability to better determine engaging content on their feeds, generative AI also creates more efficiencies for advertisers by automating their campaigns.

Hermes

Sold out of my LVMH position and replaced it with a smaller position in Hermes (will look to size this up more if it experiences more of a selloff). Hermes has held up better over the past year, still experiencing solid growth in all geographies (including China!) unlike the other luxury brands, indicating the true strength of its brand. LVMH also had too many moving parts in its business, and I prefer having a simpler luxury business to follow.

Semiconductors

Throwing semiconductors into the too hard bucket for now. Nvidia and Broadcom still look too expensive despite the recent selloff. TSMC is trading at a relatively cheap valuation but its tied pretty closely to how Nvidia performs so there’s still some decent downside risk. The semicap names such as AMAT, KLAC, ASMI are looking interesting but I don’t feel ready to bite yet.

Booking Holdings (BKNG)

This is a fantastically run business, and is a dominant player in the online travel booking industry. The stock performed well in 2024 due to strong leisure travel demand and I’ve been waiting for a sign of weakness to add to this stock. My guess is that tariffs will have a negative impact on travel demand in the short term and that the stock goes cheaper.

Alibaba and JD

Sold out of my call options – too much downside risk here if trade tensions escalate between China and US. I suspect things get worse before they get better so I’m going to sit on the sidelines.

Outlook

Feeling pretty cautious at the moment, but looking to buy quality stocks if they get cheap enough. My guess is that the trade situation between China and the US worsens before it gets better which will cause a lot of volatility in the short term.